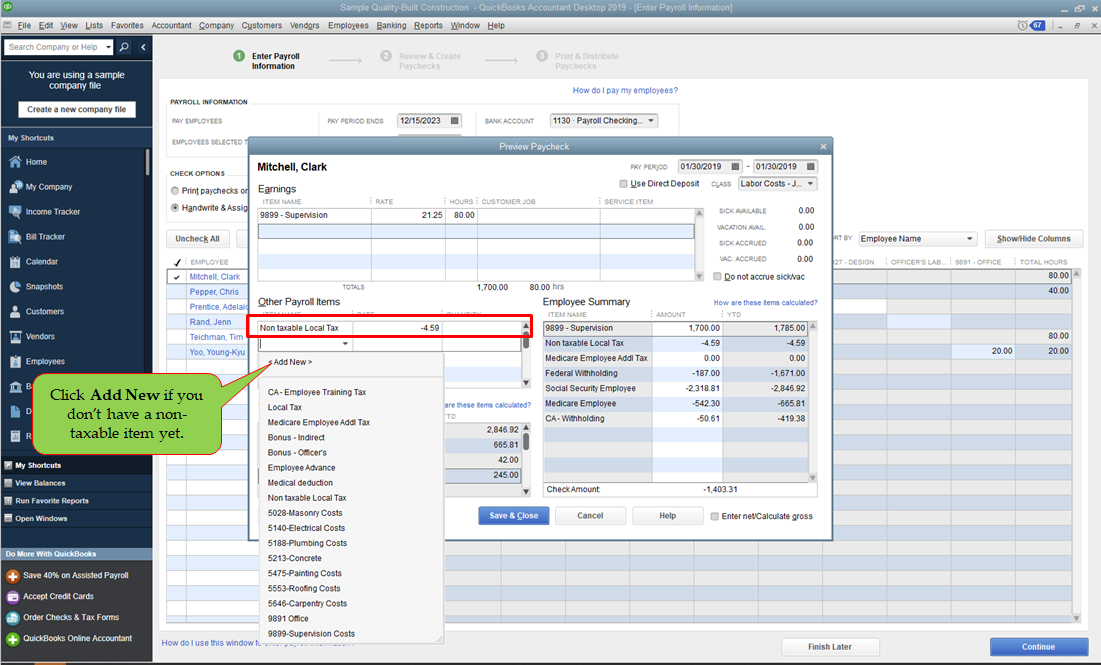

WebAdjustment of Service Input Credit towards Tax Liability. Under Service Tax rules Service Tax is payable monthly or quarterly depending on the Taxable Person. If you’re a individual, proprietary firm and partnership firm, service tax is payable Quarterly. WebQuestion is ⇒ In Service tax Credit Adjustment (%) should be either, Options are ⇒ (A) 0.2, (B) 0.3, (C) 1, (D) Both A and C, (E) , Leave your comments or Download question paper.. Web“(3) Where an assessee has paid to the credit of Central Government service tax in respect of a taxable service, which is not so provided by him either wholly or. WebAdjustment of excess paid service tax: sub-rule (4B), the following sub-rule shall be substituted, namely:- "(4B) The adjustment of excess amount paid, under sub-rule (4A),.

In Service Tax Credit Adjustment Should Be Either, 2023 Tax Updates Landlords Should Know, 1.24 MB, 00:54, 395, American Apartment Owners Association, 2022-09-29T22:55:48.000000Z, 19, Service Tax Adjustment for Submitted Entries : QNE Software Sdn. Bhd., support.qne.com.my, 884 x 429, png, adjustment tax sst deferred, 20, in-service-tax-credit-adjustment-should-be-either, KAMPION

WebAnswer 1: When an Assessee is not able to correctly estimate his service tax liability, he shall pay the service tax on a provisional basis after making a. WebTax credits are your best shot to reduce your tax liability. When you qualify for a tax credit, you get an exact dollar-for-dollar reduction in the amount you owe. For. WebIf you have a bill it means either you owe someone money cause they gave it to you first or you owe someone payment for a service...either way, if you owe someone. WebSub-section (2) of section 92CE provides that the excess money receivable from the AE as a result of primary adjustment should be repatriated by the AE to the. WebAn accounting credit adjustment helps a company correct errors in its books, abide by regulatory guidelines and ascertain the value of specific accounts.. WebGenerally, if the foreign source income is taxed at the 28% rate, then you must multiply that foreign source income by 0.7568 and include only that amount in your. WebIn Service tax Credit Adjustment (%) should be either Service tax में क्रेडिट के Adjustment (%) या तो... होना चाहिए। - 44969701 . Abhishekmanhar. WebFind an answer to your question In Service tax Credit Adjustment (%) should be either apatal877013163 apatal877013163 12.02.2021 English Primary School. WebAdjustment of Service Tax Input Credit. CA Vibhash Kumar Sah (Associate Manager) (700 Points) 01 December 2010. Dear All, Our company has taken different.

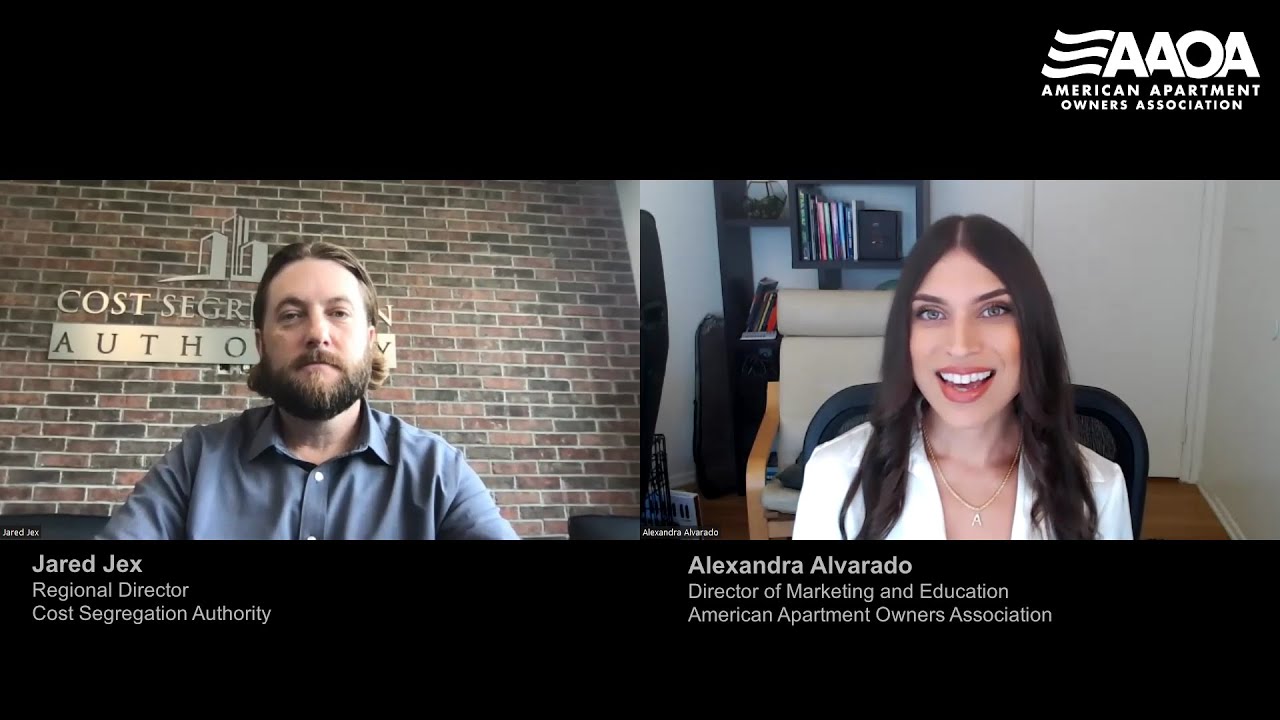

Here 2023 Tax Updates Landlords Should Know going viral

Viral How To Set Your W4 Tax Form to Get a Refund or Break-Even updated

Explanation In Service Tax Credit Adjustment Should Be Either Next

Did you know you may be missing out on major tax credits, deductions, and deferrals? Join us to learn the latest tax strategies your CPA probably isn’t telling you about

In this 60-minute webinar led by Cost Segregation Authority you will learn:

- How to use the §45L Tax Credit (Energy Efficient Home/Dwelling Unit Credit)

- How new updates to the Inflation Reduction Act may affect you

- How to use the §179(D) Tax Deduction for Multifamily Developments

- How to use cost segregation to depreciate assets faster and reduce your tax bill

#costsegregation #landlord #realestateinvesting

Reviews Service Tax Adjustment for Submitted Entries : QNE Software Sdn. Bhd. update

Discussion Service Tax Adjustment for Submitted Entries : QNE Software Sdn. Bhd. updated

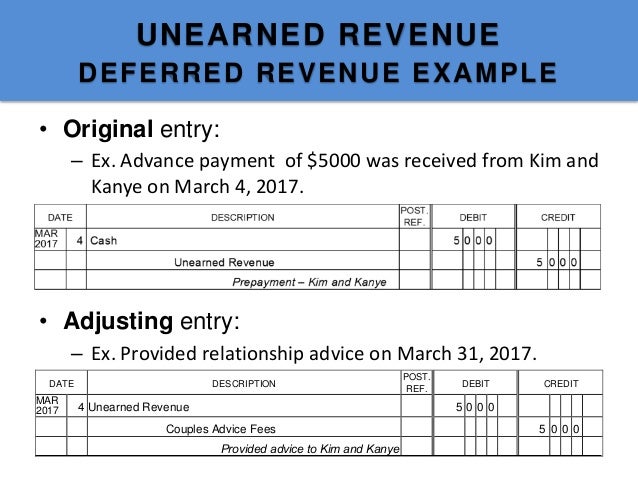

Reviews Introduction to Adjust Entries New

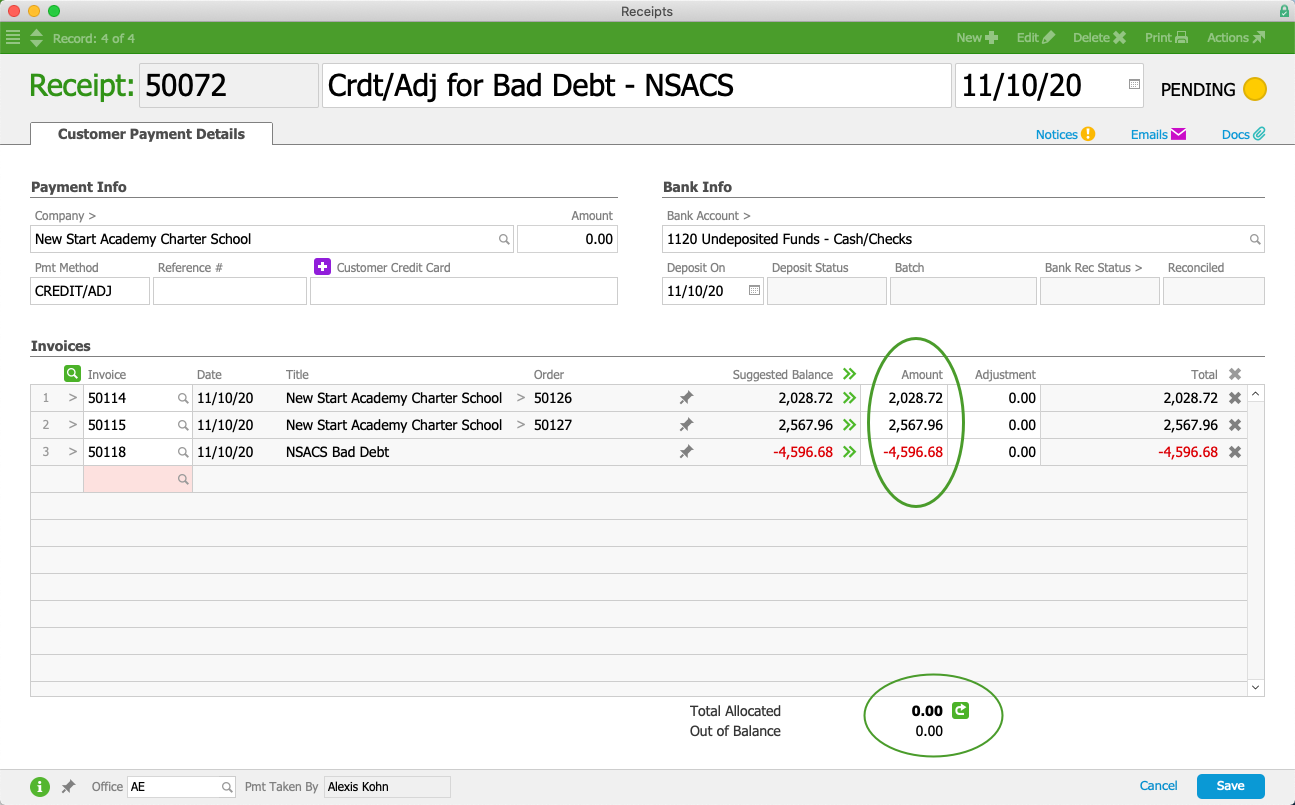

Here Writing Off Bad Debt | aACE 5 more

Input tax credit simplified | Articles | RAI GlobalLinker Latest

View A Company Started the Year With 10000 of Inventory

Look 3.17.21 Credit and Account Transfers | Internal Revenue Service

Must see Quickbooks Learn & Support Online | QBO.Support – Direct Deposit Tax updated

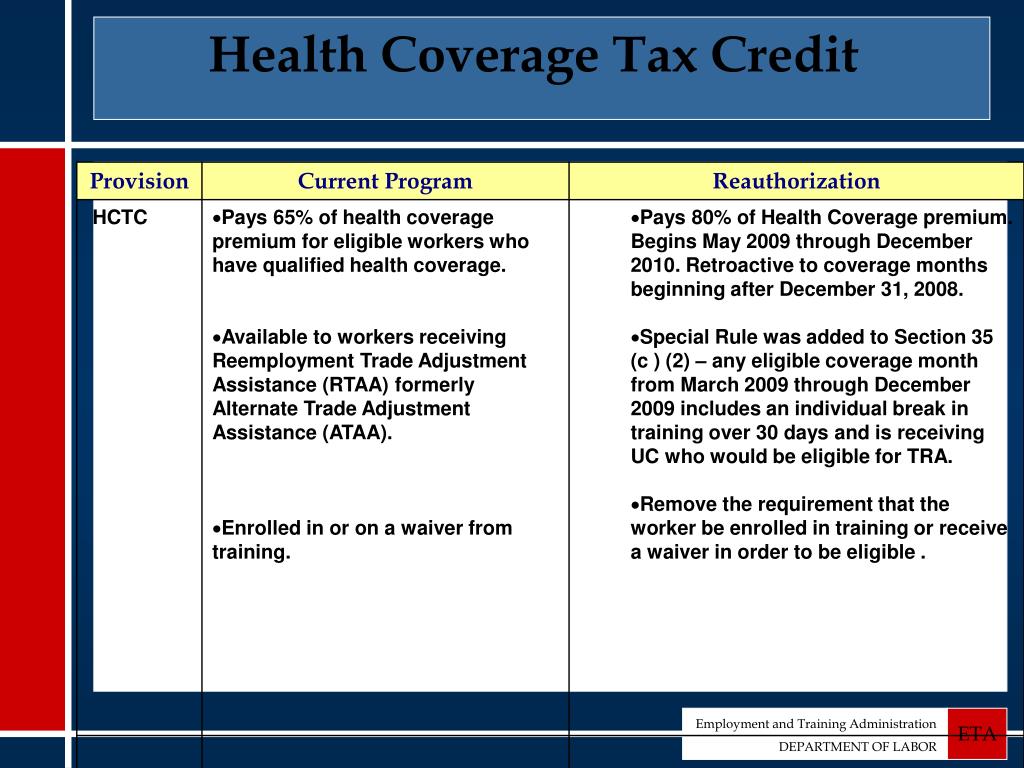

New PPT - Trade and Globalization Adjustment Assistance Act of 2009 viral

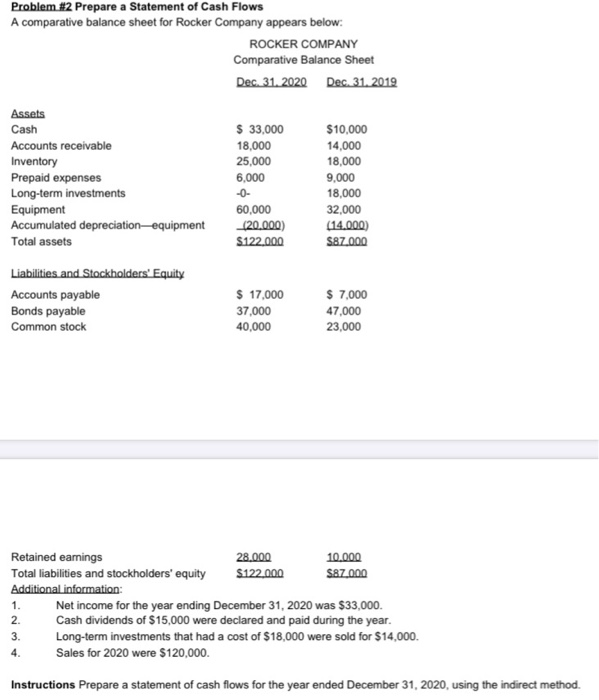

Look Solved Make the necessary adjustment at year-end, December | Chegg.com updated

Belum ada tanggapan untuk "Reviews In Service Tax Credit Adjustment Should Be Either Ideas"

Posting Komentar